IRS

Premium Only Plans (POP) can generally be defined as a type of Cafeteria Plan where the only pre-tax benefit available to employees are for those of insurance premiums. Now, whenever non-taxable benefits are involved, the IRS will usually have some strict rules in place that must be followed. For Cafeteria Plans, these are referred to as non-discrimination rules, and these rules are in place to ensure the plan doesn’t discriminate in favor of highly compensated and/or key employees.

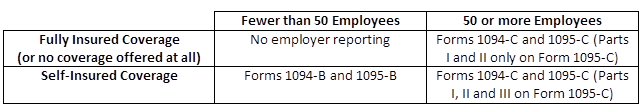

The new reporting requirements that some employers will be subject to starting next year, as required by the Affordable Care Act (ACA), will be used to help the Internal Revenue Service (IRS) enforce the Individual and Employer Mandates, and it will also help the IRS administer subsidy eligibility in the Exchanges.

The following reporting forms will be the responsibility of the employer to complete:

PCORI Fees

What happens to Health and Dependent Care FSAs when a merger or acquisition occurs?

Benefits Buzz

Enter Your Email