employers

Each year employers must provide a written notice to Medicare-eligible employees who are covered under their group health plan. The notice must include information about the creditable coverage status of the prescription drug benefit. In other words, the notice tells employees if the prescription drug benefit on the group health plan is at least as good as the standard Medicare Part D plan.

Annual Medicare Part D reporting is required for all employers who provide health benefits with prescription drug coverage. The reporting is an online filing to the Centers for Medicare & Medicaid Services(CMS), and it lets CMS know if the prescription drug coverage available on the employer’s health plan is “creditable.”

The new reporting requirements that some employers will be subject to starting next year, as required by the Affordable Care Act (ACA), will be used to help the Internal Revenue Service (IRS) enforce the Individual and Employer Mandates, and it will also help the IRS administer subsidy eligibility in the Exchanges.

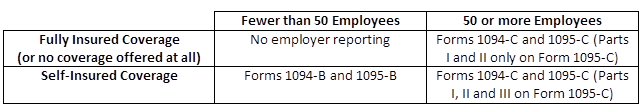

The following reporting forms will be the responsibility of the employer to complete:

Benefits Buzz

Enter Your Email