Employers

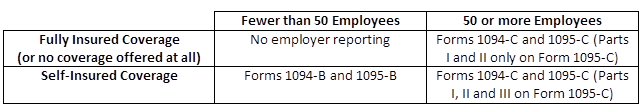

The new reporting requirements that some employers will be subject to starting next year, as required by the Affordable Care Act (ACA), will be used to help the Internal Revenue Service (IRS) enforce the Individual and Employer Mandates, and it will also help the IRS administer subsidy eligibility in the Exchanges.

The following reporting forms will be the responsibility of the employer to complete:

PCORI Fees

The Protecting Affordable Coverage for Employees (PACE) Act, signed into law by President Obama on October 7, 2015 gives states the ability to continue to determine the size of their small group market rather than conforming to a national standard.

Most states currently define their small group market as employers with up to 50 employees, but the Affordable Care Act (ACA) was set to expand that definition in 2016 to include employers with up to 100 employees. The PACE Act allows each state to independently decide what small group market definition makes the most sense.

The 2016 Medicare Part D annual enrollment period will begin on October 15, 2015 and run through December 7, 2015. Medicare beneficiaries can enroll in a Part D drug plan or make changes to existing coverage during this time period. Enrollment can be done through a stand-alone drug plan or a Medicare Advantage plan that integrates coverage for medical and drug expenses.

The open enrollment period (OEP) in the individual market will begin on November 1, 2015 and end on January 31, 2016.

During this time period, just about anyone can enroll or make plan changes to coverage in the individual market.

Here are some helpful reminders as the OEP approaches:

Who is eligible for a subsidy?

There are a number of factors that affect eligibility or can disqualify an individual for a subsidy, such as:

On October 1, 2015, the medical industry launched ICD-10 in the U.S. ICD-10, which stands for the International Classification of Diseases, 10th revision, is a medical classification system adopted by the World Health Organization (WHO). Simply put, it’s an international coding system that requires physicians, hospitals and other medical providers to assign a unique number for every patient disease, diagnosis, abnormal finding, cause of injury, etc.

- HSA contributions are tax deductible……just like 401(k) contributions.

Benefits Buzz

Enter Your Email