Employer Mandate

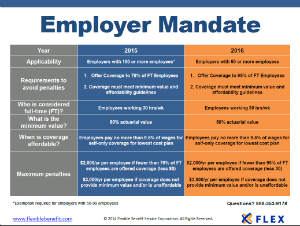

Yesterday, IRS officials made a significant announcement that impacts the Employer Shared Responsibility requirements, also known as the Employer Mandate. New guidance issued by the IRS confirms that a new phased approach will be utilized to implement it.

The new approach has 3 significant changes to the previously written rules:

The Exchanges are supposed to have verification systems in place to help determine if an enrollee has access to affordable health insurance coverage from their employer. Since the Employer Mandate reporting requirements are being delayed until 2015, the Exchanges won't have this verification system in place next year.

Instead the Exchanges will have to rely on self-reporting for this information in 2014.

By this time you have probably already heard that the Employer Mandate has been delayed until 2015. In simple terms, no employer will be penalized in 2014 for failing to offer health insurance (or failing to offer affordable health insurance).

Here are 5 key ACA items for employers to know.

The U.S. Department of Treasury announced on Tuesday that the Employer Mandate will be delayed until 2015. This rule is also commonly referred to as the Employer Shared Responsibility requirement or the Pay or Play provision.

The Employer Mandate was set to impose financial penalties starting in 2014 on employers with 50 or more full-time equivalent employees that failed to offer health insurance to employees, as well as those employers that offered health insurance that was considered unaffordable.

Benefits Buzz

Enter Your Email