Benefits Buzz

Today is the last day of February which means we are only one month away from the end of the first open enrollment period for individual health plans. March 31st is the last day that individuals can sign up for coverage without a qualifying event, but there is one big question that is still looming – Will the open enrollment period get extended to a later date?

When it comes to Health Savings Accounts (HSAs), one of the most common questions we hear is, “Can people aged 65 and older contribute to an HSA?” Many people would answer no to this question, but that is not always the case.

The fact that someone turns 65 does not automatically disqualify him from making contributions to an HSA, but enrollment in Medicare does.

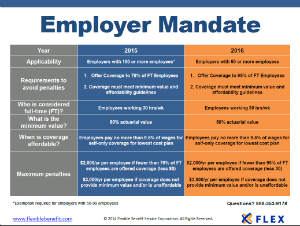

Yesterday, IRS officials made a significant announcement that impacts the Employer Shared Responsibility requirements, also known as the Employer Mandate. New guidance issued by the IRS confirms that a new phased approach will be utilized to implement it.

The new approach has 3 significant changes to the previously written rules:

- The Department of Health and Human Services (HHS) has reported Exchange application submissions have exceeded 3 million.

- The Congressional Budget Office (CBO) has updated 2014 Exchange enrollment estimates to 6 million.

- Some reports are showing that 22,000 Exchange applicants were enrolled in the wrong plan or received a lower subsidy than expected, 15,000 Exchange applications were lost and only 11% of Exchange applicants were previously uninsured.

Tag Cloud

Archives

Enter Your Email